There is no doubt that the COVID19 virus has taken over our world. With that comes great uncertainty. We are unsure what the aftermath of this pandemic represents and wonder about the economic consequences of the actions we’ve taken to save lives.

Early indicators, prior to the COVID19 crisis, pointed to a recession. You can read my previous post here. Now in April, we have more data and can make better predictions, though these are still based on several unknowns regarding the course of the pandemic, the duration and severity of which ultimately determines our actions and outcomes.

First, we should understand the difference between a Recession and a Depression. A recession is an economic contraction that generally lasts for two quarters, where real GDP is null or negative. A depression is an elongated and more severe period of economic decline. Depressions last longer, often years and see enormous decreases in employment, which obviously reduces income and buying power. Recessions are part of a normal business cycle, whereas depressions are rare and often perpetuated by significant cataclysmic events.

We remember the recessions of the past that we’ve come through. 2008 saw financial collapse, but some countries outside the USA were somewhat buffered from the experience due to their own more conservative fiscal planning and policies. People compare 2008 to what is happening now, but the catalysts for the events then and the events now are vastly different. 2008 was like a heart attack that was resuscitated with a defibrillator. 2020 is like a multiple organ shut down without any indication of where the problem is or how to cope with it.

We also consider correlations between the Great Depression of the 1920’s and 1930’s and what is happening today. There are some correlations to be found. The Great Depression which lasted from 1929 to 1933 was perpetuated by excessive war debt, high tariffs, an unequal distribution of wealth during the roaring twenties, and overproduction of consumer products. Drought in the US and Canadian prairies in 1930 which affected agricultural output was an additional blow to GDP. The stock market collapse in 1929 was a symptom of overproduction and disparity in wealth that exacerbated the tumult.

Today we face similar but deeper problems. We have a cataclysmic event on our hands in terms of the COVID19 Pandemic. There is great disparity in wealth globally. Finite resources are depleting with no replacements, and we are at historic debt levels.

DEBT

The IMF recorded global debt as USD 188 Trillion at the end of 2018. This includes both private and public debt, which is an increase of USD 3 Trillion over the prior year. [1] Historically speaking, public debt ratios are high in most countries, with 90% of advanced economies seeing debt ratios that are higher than before the 2008 financial crisis.

An additional risk here is private corporate debt, the debt ratio is now above the 2008 level with U.S. corporations reaching a record high at the end of 2018.

Corporations have feasted on rock bottom interest rates, slurping up debt like hungry pigs.

Tweet

According to data from the Federal Reserve, US corporate debt at the end of 2018 was close to USD 10 Trillion, which is 47% of Nominal US GDP of 20.8 Trillion. [2] If you add 5.4 Trillion of credit for non-corporate businesses, you are at 73% of GDP. How is this manageable by any stretch of the imagination? Why is this allowed?

Now imagine the consequences of companies defaulting on this debt due to COVID19. This is an absolute reality, and a big reason why the Trump administration is pushing to open America, even though the health threat from COVID19 has not dissipated. They can see what is coming, economically speaking.

There are other more strategic reasons for why some state governors are pushing to reopen their state. To be addressed in a future post.

As companies default and fail, unemployment rises. Without income there is no buying power, and many, many companies will fail. Using a common stimulation tool, central banks have dropped interest rates and are using Quantitative Easing (QE) strategies that appeared to work in 2008 but will not work this time. The Quantitative Easing (QE) tactic of easing borrowing and buybacks will only allow debt to grow and does little to grow an economy that is essentially built on vapor, leading to a currency that will become meaningless as more is printed.

Though low interest rates make borrowing affordable and can be a viable strategy at times, in our current situation it only adds to future financial burden and relies on consumer spending to keep the economy afloat. Consumer spending is not going to ramp up quickly to pre-pandemic levels any time soon, because individuals are unemployed, have reduced incomes, and are also highly leveraged.

The Bank of Canada reports Canadian Household debt is at USD 2 Trillion [3], while US household debt as reported by The Fed was at 15.6 Trillion. [1] The simple premise is, when people are out of work, they do not make purchases, are unable to manage their own debt, and bankruptcies abound. There are going to be numerous personal and business bankruptcies at the end of this pandemic, and thus far the end is barely visible.

Stimulus packages that try to save corporations means that governments are only adding to already exorbitant deficits, which becomes an unsustainable generational contagion.

Tweet

The foundation of this great economic idea was built on sand and the waves are now coming in. If this COVID19 storm does not drown us, the next storm will.

Unemployment

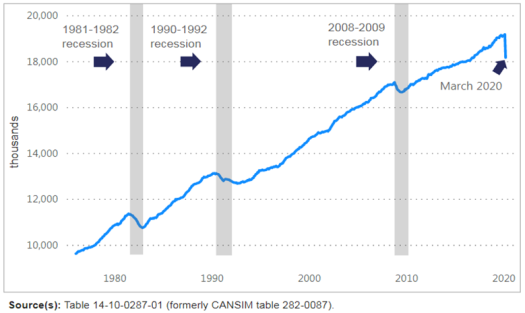

For true stimulus, individuals need to earn income and spend or invest it. According to Statistics Canada, jobs dropped by over 1 million in March 2020 over February 2020 due to COVID19 lockdowns, the sharpest drop when compared to the past three recessions. Meanwhile another 2.1 million Canadians worked zero hours or less than half the hours they normally work. [4] The true unemployment rate in Canada is 8.9% when individuals who recently worked and want a job but did not seek one, are included in employment statistics.

In the U.S., the unemployment rate rose almost 1 percent from 3.5 in February 2020 to 4.4 in March 2020. This indicates a rise of 1.4 million additional unemployed persons in March 2020, which is the sharpest percentage increase in unemployment since January 1975. [5] And this number is projected to grow into the double digits in the coming months, as businesses fail and we see a new normal emerging.

The sharp rise in the unemployment rate is directly attributed to business closures relating to social distancing measures, and though many will reopen when the virus allows, some of these small businesses will not sustain the upheaval, leaving their workers unemployed. Add to that a shift in new ways business is now conducted. Businesses that have found success with workers working from home, may continue the practice and will therefore reduce real estate and human resource needs. That is just one example of a new normal.

A Return to Normal?

Although economic pundits speak of the V Shaped rebound, which is a quick recovery due to pent up demand, this is a very unlikely scenario. Industries such as Travel and Tourism that are huge contributors to GDP, will not rebound quickly. Global losses from Travel and Tourism alone are forecasted to factor well over USD 1 Trillion. More here.

Oil and Gas is another sector that is in trouble with excess supply, reduced demand, and just recently, negative pricing. The industry comprises close to 4% of global GDP and has taken an enormous hit during the COVID19 pandemic. In the latest news Diamond Offshore Drilling Inc. has filed for Chapter 11 bankruptcy protection. [6] Chief Executive, Marc Edwards, states, “Through this process, we intend to restructure our balance sheet to achieve a more sustainable debt level to reposition the business for long-term success.” This is not the only business that will want to reposition their business in terms of debt. Many more are in line right behind Diamond.

The bottom line is, there is no return to normal. To expect that we will return to pre-pandemic levels of economic value and activity is short-sighted and plain stupid. We must adapt to a new normal, and the course of the virus will determine the roadmap. Though many countries have managed the pandemic relatively well, some were unprepared, and these countries will see enormous economic and political shifts, with even greater polarity in ideologies and wealth disparity.

Recession or Depression

All indicators point to a Depression, one that will not be easy to rebound from if we continue the course we are on and if COVID19 continues to remain a threat. COVID19 is like a wall between supply and demand. Though supply chains have been disrupted, it is up to the consumer to elevate the economy, and this is unlikely to happen in the short term, deepening fears of a depression.

Cashflow is the only way the economy will rebound, unfortunately due to debt levels corporations lack liquidity, and governments can buy assets and print money, but this will make currency meaningless and hurt asset values.

One course of action to dispel a Depression is to provide a universal income to individuals. Though this goes against our ingrained capitalist values, and increases government debt, it enables consumer spending and will help the economy in the short term, allowing a quicker rebound. Though it is unlikely that consumers will make large purchases with their stimulus checks or CERB benefits.

Of course, businesses need to be open for consumers to spend. This can be done gradually, with businesses maintaining social distancing measures. Expansive antibody testing will allow individuals who have immunity and/or have recovered, to return to work. This however requires a coordinated effort and some form of technology in the form of an app to manage contact tracing and immunity data.

What we need to come to terms with is the fact that the virus determines the schedule. If we move too slowly, we kill our economy and our world as we know it. If we move too fast a second wave would be a nail in the economic coffin. If we happen to escape the storm on the horizon this time, then now is the time to implement true fiscal and systems reform. We desperately need to give up flagrant excess and build a stronger foundation. Perhaps this means allowing our sandcastles to be washed away.

Data Sources:

- https://blogs.imf.org/2019/12/17/new-data-on-world-debt-a-dive-into-country-numbers/

- https://www.federalreserve.gov/publications/2019-may-financial-stability-report-borrowing.htm

- https://www.bankofcanada.ca/rates/banking-and-financial-statistics/selected-credit-measures-formerly-e2/

- https://www150.statcan.gc.ca/n1/daily-quotidien/200409/dq200409a-eng.htm

- https://www.bls.gov/news.release/pdf/empsit.pdf

- https://www.marketwatch.com/story/diamond-offshore-files-for-bankruptcy-stock-plunges-2020-04-27

Reblogged this on The GOLDEN RULE and commented:

Wow! A robust analysis that is easy to read and understand.

No ventures into politics, blame, personal issues as you would normally expect from a post of my own, just unadorned information.

LikeLiked by 1 person

Thanks very much for reblogging Ken! Would love to hear other opinions as well.

LikeLike

thank you, Shelley, for your analysis. As I was reading your opening paragraphs, I kept saying to myself: “Please conclude that it will just be a recession.” But you provide a reasonable basis for why it could be much worse than that. It’s ironic that consumer spending is down, yet Amazon is reacing all-time highs. I guess it’s a matter of consumers shifting their spending from physical to online, not purchasing more than normal. Ao Amazon gains while other retail businesses lose.

I am a fan of UBI, at least my basic understanding of it. It will be interesting to see if that becomes a tool to get us out of the economic collapse.

Hope you are safe and healthy!

LikeLiked by 1 person

Hi Jim, Thanks for taking the time to read. Today it was announced that US GDP was down by almost 5%. This is expected. You are right that online shopping has increased, however consumers are not purchasing big ticket items and this hurts the economy. Industries like Travel, Gas, and Automotive have been hit hard. Real Estate still to come. Many businesses will not survive this crisis, and though The Fed uses QE to stimulate the economy, it will not work fully this time, because corporations are highly leveraged.

I don’t think UBI is a long-term solution, but it may give individuals some security in this time of great uncertainty.

Thanks again for reading and for your thoughts Jim! Hope you and your family are staying safe and healthy also!

LikeLiked by 1 person

Hi Shelley. Good point about the big ticket items. And I’ve heard airline traffic is down over 90% – how do you recover from that without massive aid?

I’m a fan of UBI simply for the fact that automation/technology was supposed to make our lives easier, and give us additional leisure time. As firms become more automated and efficient through the use of robotics, those efficiency gains should result in higher profits. There will not be as much a of need for labor as a result, and those higher profits can be used to support UBI, particularly for those people who have been replaced by robotics.

LikeLiked by 1 person

You’re right air travel has taken a huge hit. The World Travel and Tourism Council is predicting a 30% loss to GDP from the industry. Travel and Tourism supports whole economies in some cases, and this decline will have a devastating effect on some countries.

I do think there is value in UBI, but as a long term solution it can actually hurt the economy and human behaviour. Funny how advanced tech has not given us more leisure time. Don’t we all feel like we’re working non-stop. UBI is a considerably complex topic. I think you’ve given me an idea for a future post. 🙂 Thanks Jim!

LikeLiked by 1 person

well maybe there will be good travel deals for thos brave enough to travel (not me, I think I’ll wait until there is a covid-19 vaccine).

I’d love to see you do one of your posts on UBI, since you always do such a thoughtful analysis. I wrote a couple of posts about it a few years ago, but more as an overview of what it is.

LikeLiked by 1 person

Thanks for the links Jim! I’ll check them out. I think many feel as you do about travel. And yes, I think I’ll dig in to UBI. Appreciate your kind words!

LikeLiked by 1 person

Fortunately, there is nothing I HAVE to travel for as I look into the future. And I look forward to your post about UBI!

LikeLiked by 1 person